Construction companies hit hard by growing waits for payment as debtor days increase sharply

27 November 2017

- Hard hit construction companies waiting 69 days to get paid

Hard hit businesses in the construction sector are continuing to suffer from steadily increasing delays for their invoices to be paid, says Funding Options, the online business finance supermarket.

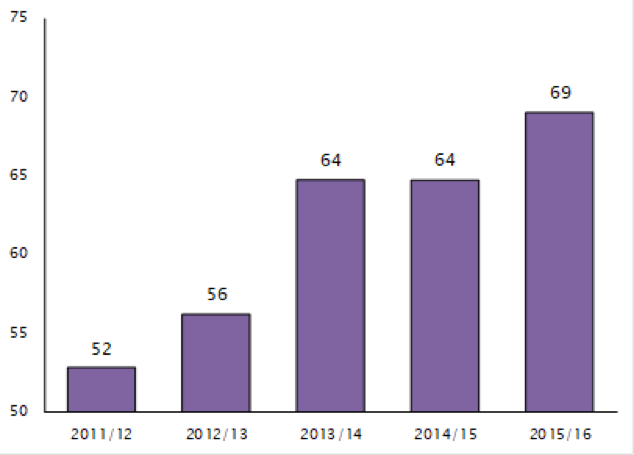

Funding Options says that its analysis of 13,213 UK construction businesses shows that they now face an average wait of 69 days for their invoices to be paid in the last year, which is a sharp 8% increase from the 64 days wait in 2014/15.

Average days wait for invoice payment for construction sector businesses

A single late payment can be an issue even for successful firms, which can be caught out if a major client delays a payment significantly. If that late payment coincides with a major bill coming in, such as a tax, VAT or rent payment, the consequences can be severe.

Funding Options adds that delays in paying one lead construction contractor could put jobs at risk all along the supply chain. The construction sector has a long supply chain which includes many small and medium sized enterprises.

Funding Options says that slow payment of bills is a major reason why the construction sector has such a high number of insolvencies. 2,557 construction firms entered insolvency in the year ending 2016.

Conrad Ford, CEO of Funding Options says:

“September’s PMI report records makes ominous reading with the British construction sector having contracted for the first time since the Brexit vote.”

“What this data again underlines is that the construction sector has a persistent problem getting clients to pay early on and this is only a further woe to add to the list.”

“The aftermath of the Brexit vote suggests a fragile confidence, and a subdued appetite for risk, especially in the commercial building sector.”

“Long supply chains in industries like construction mean that the ripple effect of delays is likely to affect many other businesses further down, with SMEs hit the hardest. In an industry with high overheads in terms of materials and labour costs, this can be difficult to deal with.”

“These figures show that it’s more important than ever that the construction sector fully understand the options available to them to free up the funds they require and to minimise the impact of late payment and other poor payment practices.”

“There is a wide range of choices out there for small businesses seeking funding — invoice finance, asset finance, crowdfunding and peer-to-peer lending can all provide the liquidity businesses need. Unfortunately, small businesses' leaders often don’t know which sort of finance is the best fit for a particular need, or who is out there to provide it.”

“At Funding Options, we’re able to scour our extensive panel of lenders across the spectrum to put together a funding package for a business, no matter how complex, urgent or challenging its situation.”