Northern SMEs suffering far more aggressive cuts in bank overdrafts than London businesses

9 November 2015

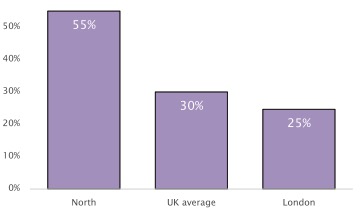

- 55% of Northern SMEs have seen overdrafts reduced or withdrawn in last two years

- 'Northern Powerhouse' growing slower than London economy

Northern small businesses are suffering much more aggressive cuts in their bank overdrafts than those based in London, according to research by Funding Options, the online business finance supermarket.

Research commissioned by Funding Options shows that 55% of small businesses in the North have seen their overdrafts reduced or withdrawn entirely in the past two years alone, compared to just 25% of London SMEs*.

It says that although the bias against northern businesses has receded over the years, these figures show that it still may be lingering.

Funding Options adds that the figures demonstrate that the £5 million per day that banks have cut from SME overdrafts every day over the last four years has not been uniform across the UK, with the Government’s Northern Powerhouse bearing the brunt of banks’ retreat from provision of working capital finance to small businesses.

Funding Options adds that recent high street bank statistics* show that economic growth in the North-West is currently 2.6% per year, while growth in the North-East is running at just 2.4%. Both trail economic growth in London, which is running at 3.3% per year**.

Funding Options, based in Manchester, says that sharp reductions in working capital through overdraft cuts are the ‘hidden credit crunch’ affecting Britain’s small businesses, and that the North has been disproportionately affected.

55% of northern SMEs see overdrafts cut in last two years, versus just 25% in London

It adds that the withdrawal of overdrafts is one of the biggest drivers of the increasing use of alternative finance, such as invoice finance, asset finance, bridging loans and peer-to-peer lending.

This is only likely to increase with the launch of the government’s alternative finance referral scheme, under which banks will refer SMEs they turn down for funding to alternative finance platforms. The scheme is expected to launch in early 2016.

Conrad Ford, CEO of Funding Options, says:

Reductions in small business overdrafts are cutting off the fuel for the Northern Powerhouse.

The ongoing reductions in overdrafts for small businesses is the hidden credit crunch, and while the whole country has been affected, the North has been hit a lot harder than London.

As the banks have been forced to reduce their exposure to small business lending, they have focused on overdrafts as a risk that can be eliminated with relative ease, and at short notice.

We’re now approaching the end of the business overdraft as a tool for working capital.

SME bank overdrafts cut by £8.4bn since 2011 – that’s £5m every single day

* Based on a survey of 250 small business owners

** Source: RBS Regional Growth Tracker Q2 2015