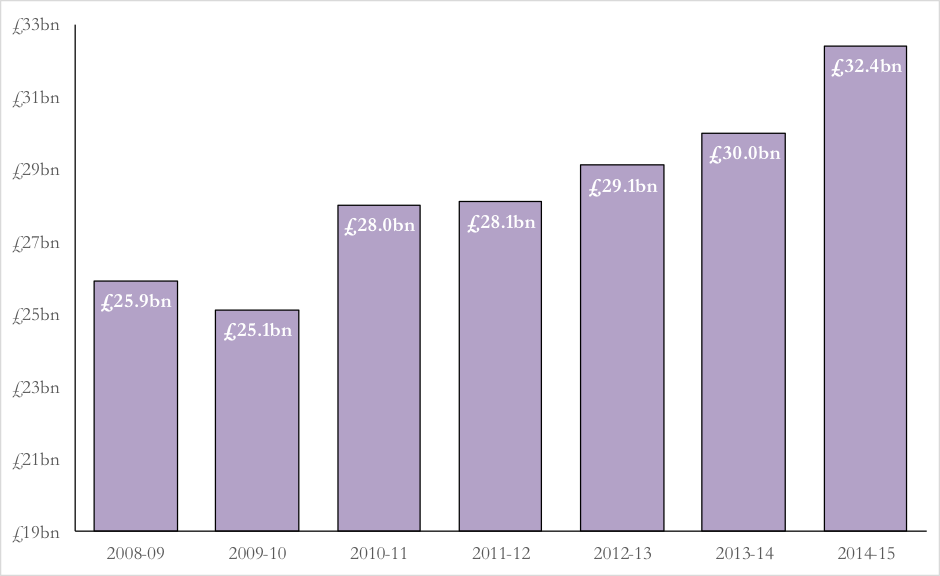

Record high £32 billion corporation tax paid by UK ‘real economy’ businesses

5 September 2016

A record high £32.4 billion in corporation tax was paid by ‘real economy’ UK businesses last year, up 8% on the £30 billion paid the year before (see data below), says Funding Options, the online business finance supermarket.

Funding Options says that this shows that there is now scope for the government to reduce the corporation tax rate for SMEs.

These figures exclude financial services businesses and North Sea oil and gas companies.

The extra tax taken from mainstream UK businesses has been plugging the steeply reduced tax take from North Sea oil and gas. Corporation tax revenue from North Sea oil companies fell from a peak of £10.2 billion in 2008/2009 to just £2.5 billion last year — the lowest level since 1999/2000.

Conrad Ford, CEO of www.fundingoptions.com says:

“With the corporation tax take now at record levels the government can now afford to ease the tax burden on small business.”

“Reintroducing a lower corporation tax rate for small businesses would be a major and deserved boost to UK SMEs.”

“Small businesses in the UK benefitted from a lower rate of corporation tax for over 40 years until 2015. This was an effective way of helping small businesses to compete with larger rivals and would be so again.”

“Small business are an engine of growth and new jobs — the government should be doing all it can to foster a business culture that allows SMEs to thrive.”

“Another option for helping SMEs would be to increase the Annual Investment Allowance encouraging small businesses to invest in new equipment or upgrades on their existing capacity.”

The Annual Investment Allowance gives businesses tax relief to encourage capital investment. The size of the relief is currently £200,000 per business per year, down from £500,000 in 2015 and £250,000 in 2014.

“Increasing the Annual Investment Allowance would mean that restaurants could invest in new kitchens, manufacturers could invest in new machinery, and design businesses could invest in new IT.”

Corporation tax receipts from UK businesses are at a record high…(excludes financial services and oil & gas)

…but are they having to plug the gap left by rapidly falling revenue from North Sea oil & gas companies?

Data source: HMRC — most recent available figures

NB: The additional rate of corporation tax that North Sea oil & gas companies pay – the supplementary charge – was cut from 20 to 10 per cent in the March 2016 Budget but this has not affected the above figures